A Comprehensive Look at Bearer Assets - Part 2

The Significance of Self-Custody: Who would find it important?

We have established the rarity of assets that can be held and transacted personally, eliminating the need for a trusted third party, all while remaining liquid, fungible, and easily portable. These unique assets include government paper, scarce long-lasting elements, and digitally-scarce networks with the scale to fend off imitators. Gold has stood the test of time for thousands of years, the current fiat US dollar version has been in circulation for around 50 years, and bitcoin, the pioneer of this concept, is approximately 12.5 years old.In essence, this refers to money that derives its value from within, enabling two strangers to conduct transactions on the street even if their preferences differ, thus eliminating the possibility of bartering.The question then is, why should we care about this property of self-custody? Do only criminals care about it?Not necessarily. The significance of self-custodial money largely depends on individuals' backgrounds, life experiences, and the level of trust they have in their local financial system and government. In other words, there are numerous practical applications for money-like assets that offer the bearer this level of control and ownership.Application 1: Regular and Emergency Backup

It is recommended to keep a certain amount of physical cash available for minor inconveniences or unexpected emergencies.Have you ever found yourself in a restaurant with only cards but no cash, and encountered a situation where your cards unexpectedly fail to work? Suddenly, you're unable to exchange value with someone even though you owe them for the meal. Besides the practical challenges of resolving such a scenario, most individuals understandably dislike the feeling of embarrassment and disempowerment that accompanies it. It's beneficial to have some cash on hand in such situations.Moving beyond these everyday instances, we can envision more critical scenarios. When traveling in a foreign country, especially one with less developed infrastructure, the loss of your preferred payment methods could pose a significant issue. Imagine not having any cash and your cards being unresponsive or unusable. What steps would you take?Consider if you had memorized a bitcoin wallet seed phrase, granting you access to your funds from anywhere in the world with an internet or satellite connection. This could be crucial in situations where personal belongings are stolen.Additionally, let's think about financial or electrical crises. In 2015, Greece's economic crisis led to limitations on bank withdrawals, capping them at 60 euros per day due to a bank run. This required people to endure lengthy queues just to access a small amount of cash. Having cash, gold, or bitcoin on hand before this crisis emerged proved wise.Similarly, in 2017, Hurricane Maria devastated Puerto Rico, causing power outages and rendering credit card payments impossible. Cash became essential, yet many banks were closed or restricted withdrawals to $100 per day, resulting in extensive lines. Bitcoin wouldn't have been practical in this situation, but physical cash, gold, or silver would have been valuable.Alternatively, if you're in an emerging market and your local currency experiences significant inflation (a sadly common occurrence affecting billions), owning gold or bitcoin becomes valuable for preserving value, alongside finite assets like real estate.In various circumstances like these, having physical cash, gold or silver coins, and possibly even bitcoin stored away for emergencies is a prudent choice. Each asset has its moments to shine, and they all share the characteristic of enabling individuals to directly possess a portion of their assets without relying on a third party.Application 2: Providing Banking Services to the Underbanked

Approximately two-thirds of the population in El Salvador lacks access to traditional banking services, reflecting a global trend where billions of people lack bank access. However, a significant portion of these individuals possess affordable mobile phones and basic internet connectivity. This number is steadily growing due to the decreasing costs of technology. Interestingly, providing someone with a phone has become easier than setting up a bank account.This concept laid the foundation for Bitcoin Beach, a collaborative effort between charitable organizations and bitcoin enthusiasts. Over the past few years, they leveraged Bitcoin's Lightning network to offer fundamental banking services to the population. Using their phones, users could engage in instant peer-to-peer transactions, store assets as BTC, or convert them to USD. The CEO of Strike, Jack Mallers, turned his focus to using the Lightning network for international remittances in the country. This mirrors the application of software to enhance efficiency, akin to how software has revolutionized other traditional industries.Recently in 2021, El Salvador's president took notice of this success. Together with the legislative body, they decided to legalize bitcoin as an official form of currency and actively promote its adoption. It's worth noting that El Salvador isn't necessarily a model of international prosperity; in fact, the country faces significant challenges. However, for those tracking the progression from Bitcoin Beach to efficient remittances to legal tender, the developments in El Salvador aren't entirely surprising. The country's challenges, in fact, prompted various communities to introduce bitcoin-based technologies as a testing ground.While the ultimate success is yet to be determined, the availability of more options is undeniably a step forward. In Latin America, several politicians in multiple countries have also publicly expressed interest in implementing similar bitcoin-related measures. Time will tell whether any of these countries choose to follow in El Salvador's footsteps.In the next phase of this live experiment, El Salvador's President has declared plans to harness the country's volcanic geothermal energy for Bitcoin mining. Building electrical transmission systems is often prohibitively expensive, leaving even cheap energy sources untapped globally.A unique benefit of Bitcoin mining is its ability to be located near the energy source, bypassing the need for costly transmission to other locations. This enables quick monetization of new energy sources. Renewable energy options that may have been financially unfeasible for long-distance transmission or export can now be localized for Bitcoin mining to generate income.In the future, the focus could shift from mining to diverting this fully harnessed energy toward other demands through expanded infrastructure.Application 3: Safeguarding Against Dubious Authorities

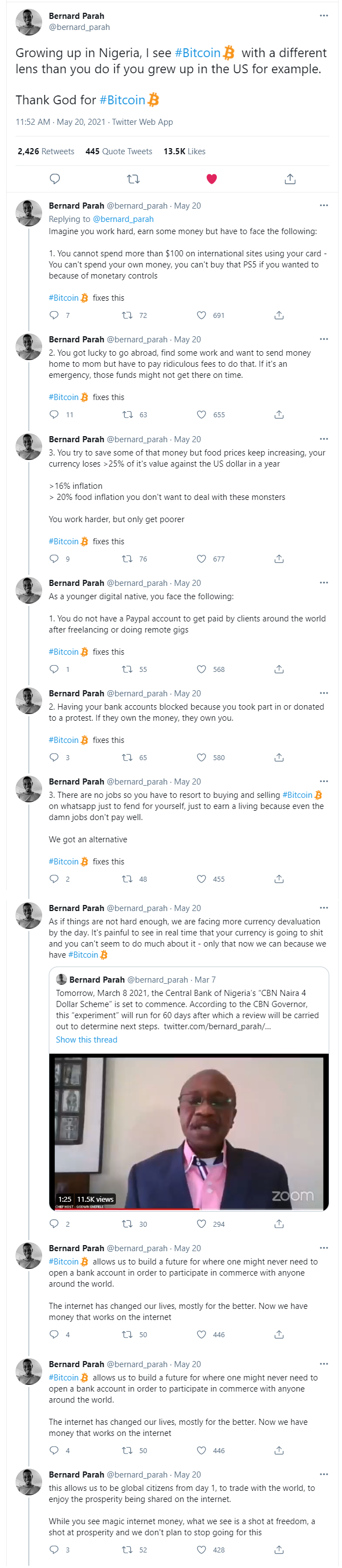

Article 12 of the UN's Universal Declaration of Human Rights states that privacy is a fundamental human right, and any arbitrary invasion of it is a violation of human liberties. Despite this, privacy infringements are rampant globally.When entities like governments and corporations have the ability to compromise your privacy, they inch closer to infringing upon other freedoms like speech. While this may not be a pressing issue in politically stable regions, most of the world's population resides in areas where free speech and expression are restricted. This underscores the need to safeguard privacy even in seemingly benign political climates.Under the framework of Article 12, individuals have the right to employ technology that shields their privacy, and only in cases where there's reasonable suspicion of criminal activity should authorities lawfully collect data. This puts the onus on the entity—be it governmental, corporate, or individual—wishing to breach someone's privacy or block transactions.In early 2021, Reuters highlighted that Alexei Navalny, Russia’s opposition leader, accepts Bitcoin donations to counteract Russian authorities' attempts to freeze his Anti-Corruption Foundation's bank accounts. Using Bitcoin serves as a form of insurance against traditional financial channel closures.Similarly, Bernard Parah, CEO of Bitcoin-saving app Bitnob, shared on social media the challenges many Nigerians face in financial transactions, explaining the rising popularity of peer-to-peer Bitcoin transactions in Nigeria:Amid ongoing inflation issues, Nigeria's central bank has prohibited its financial institutions from engaging in cryptocurrency transactions. Nonetheless, peer-to-peer Bitcoin trading remains strong, not only in Nigeria but also in various other Sub-Saharan African countries.Well-known podcaster Anita Posch dedicates a series to exploring Bitcoin's role in Africa, even traveling to Zimbabwe to study its specific applications there.In a similar vein, Alex Gladstein from the Human Rights Foundation wrote an article called "Check Your Financial Privilege," scrutinizing Bitcoin's relevance in emerging markets. He also discussed the cryptocurrency's impact on human rights during an appearance on The Investor's Podcast. A particularly poignant segment focused on Venezuelans who were early adopters of Bitcoin mining. Despite facing government crackdowns, some have been able to flee and rebuild their lives in places like Canada, thanks to the digital assets they were able to take with them.Another compelling story Gladstein shared involved an individual who fled to Argentina after being wrongfully labeled a criminal by his government. He now supports his mother in Venezuela through Bitcoin transactions.What struck Gladstein, whose own family history includes the Holocaust, was the revolutionary potential of being able to take one's wealth along while escaping oppressive regimes. Unlike in the past, when refugees could only carry physical belongings, Bitcoin allows people to take their wealth with them in digital form. This has been particularly useful for individuals fleeing countries like Iran and Syria, converting assets like real estate into Bitcoin to maintain their wealth while seeking refuge.Gladstein spoke also to individuals have fled nations grappling with extreme inflation of something like 150 or 200%, such as Sudan. For example, a Sudanese man now residing in Europe sent cryptocurrency back to his family in Khartoum, enabling them to make ends meet. Despite Bitcoin's growing popularity, estimates indicate that only about 10% of Americans and significantly fewer people globally have engaged with it. In emerging markets like Turkey, Argentina, and Nigeria, however, cryptocurrency adoption is higher on a per capita basis.Alex Gladstein has highlighted Bitcoin's role as a financial tool in Afghanistan, where the locals face numerous challenges such as underbanked population and gender-related risks in which females are often threatened for working or owning property. One remarkable story is that of Laleh Farzan, who had to flee Afghanistan due to threats from conservative factions. Though she lost physical assets along the way, she managed to keep her Bitcoin holdings by cleverly hiding her wallet's seed phrase.. She had 2.5 BTC from 2013 which is now worth a fortune. Bitcoin's availability and decentralized nature make it a unique asset, particularly beneficial in emerging economies with unstable currencies. Its own transactional network eliminates the inefficiencies found in traditional payment systems. Even in regions without conventional internet, satellite technology enables Bitcoin transactions.In developed countries like the United States, content creators facing de-platforming have turned to Bitcoin to secure their financial transactions. This adoption is part of a broader trend: Law enforcement agencies in the U.S. now seize more cash annually than burglars, highlighting Bitcoin's potential as a safeguard against such practices.Chart Source: Washington PostA significant portion of the funds confiscated originates from criminals. However, it is important to note that individuals do not necessarily have to be found guilty or charged with a crime for the police to seize their physical cash or other assets. Following increased public awareness, there was a surge in scrutiny and subsequently reported figures began to decrease.In 2018, the Washington Post highlighted numerous instances of civil forfeiture that did not involve criminal activity, often resulting in lengthy delays before individuals could reclaim their confiscated funds. This practice disproportionately burdens individuals with low incomes who lack the resources to initiate legal proceedings to recover their property. According to Darpana Sheth, senior attorney and director of the Institute for Justice's nationwide initiative to combat forfeiture abuse, civil forfeitures occur on a daily basis.Civil forfeiture operates under a lesser-known legal mechanism, whereby the government can permanently seize an individual's property if an officer suspects it is connected to a crime. Unlike criminal cases where forfeiture occurs after a conviction and is ordered by a judge as part of a sentence, in civil forfeiture, even if the rightful owner is not charged with any crime, they still face the potential permanent loss of their property.Darpana Sheth, the senior attorney and director of the Institute for Justice's nationwide initiative to combat forfeiture abuse, states that civil forfeitures occur on a daily basis.Traditionally employed in cases involving piracy and admiralty, where a crime is alleged to have occurred overseas, civil forfeiture operates by targeting the property itself rather than the individual. According to Sheth, this concept is based on a legal fiction that considers the property guilty.As from Wikipedia, In the United States, civil forfeiture, also known as civil asset forfeiture or civil judicial forfeiture, is a process where law enforcement officers seize assets from individuals suspected of being involved in criminal or illegal activities, without necessarily charging the owners with any wrongdoing. Unlike civil procedure, which typically involves a dispute between two private citizens, civil forfeiture revolves around a dispute between law enforcement and the property itself, such as a sum of money, a house, or a boat, which is suspected of being connected to a crime. To regain the seized property, owners must prove that it was not involved in criminal activity. Civil forfeiture can encompass both the act of seizure and the threat of seizing property. It is important to note that civil forfeiture is not considered a form of criminal justice financial obligation.Supporters view civil forfeiture as a potent tool for combating criminal organizations engaged in illicit drug trade, which generates annual profits of $12 billion. They argue that it empowers authorities to confiscate cash and other assets from suspected drug traffickers, serving as an effective means to combat illegal activities. Additionally, proponents assert that civil forfeiture allows law enforcement agencies to utilize the seized proceeds in their ongoing efforts against crime, thereby directly impacting suspected criminals economically while providing financial support to law enforcement.Critics contend that innocent owners can become entangled in the process, leading to potential violations of their Fourth and Fifth Amendment rights, as they are presumed guilty instead of presumed innocent. In fact, a judge in South Carolina has deemed civil forfeiture unconstitutional. Detractors also argue that the system creates incentives for corruption and misconduct among law enforcement officials. While there is consensus that abuses have occurred, there remains disagreement regarding the extent of such abuses and whether the overall societal benefits outweigh the costs associated with these instances of abuse.According to a Washington Post report in 2020, Homeland Security confiscated over $2 billion in cash at airports between 2000 and 2016, with approximately 70% of cases lacking any arrests. Individuals typically had to endure months of legal proceedings to potentially recover their seized funds, and even then, there was no guarantee of retrieval. The burden of proof lay on the individuals to demonstrate their rightful ownership of the cash, rather than on those who confiscated it.Considering the extent of this issue in the United States, one can only imagine the corruption faced by people in developing countries due to arbitrary confiscations.Individuals often face the risk of having their funds seized when transporting cash or gold through airports, particularly across international borders. Those fleeing from war-torn regions or failed states typically encounter difficulties in bringing along valuable possessions. Bitcoin presents an intriguing solution as its private keys can be stored in an app on a password-protected smartphone (which is now accessible to nearly 4 billion people) or even memorized as a seed phrase. This digital currency moves discreetly and with encryption.The presence of encrypted money, both as a potential store of value and a transaction network, creates challenges or even impossibilities for questionable authorities to block transactions or seize funds. Moreover, such authorities may remain unaware of the existence of these funds, similar to when individuals travel with a smartphone or memorized seed phrase that grants access to a Bitcoin wallet rather than carrying physical cash.Even legitimate authorities are generally wary of this technology due to its potential for misuse. However, the crux of the matter revolves around the level of privacy and self-autonomy individuals should possess, as well as the question of who should bear the burden of proof when it comes to seizing assets or obstructing transactions.This is why the Human Rights Foundation (HRF), a nonprofit organization chaired by Garry Kasparov that focuses on global human rights issues, actively supports the Bitcoin network and operates the HRF Bitcoin Development Fund.Criminals often adopt new technologies early on because they have a strong incentive to innovate in such ways. However, this does not imply that the technology itself is inherently problematic. The emergence of new discoveries and their applications is inevitable. Banning Bitcoin, which fundamentally represents basic yet elegant technology, would essentially be a ban on information—a prohibition on utilizing an open-source decentralized public ledger with numerical access. That is why developed countries with a strong rule of law have emphasized regulating Bitcoin and ensuring the government receives its share of capital gains taxes.To draw a parallel example, criminals were early adopters of beepers in the 1980s, but that did not make beepers themselves inherently bad. Here is an excerpt from a Washington Post article from July 1988:When a drug dealer is in trouble, he sometimes dials 911. But he isn't trying to reach the police. Instead, this message is sent to a drug courier wearing a beeper that displays messages dialed from a phone: 911 means the police are closing in. Although paging devices, or beepers, have gained popularity across various industries—doctors, delivery people, and journalists often use them—they have also become a staple in the drug trade, posing new challenges for law enforcement and potentially tarnishing the reputation of a rapidly growing high-tech industry.Officials estimate that there are around 6.5 million beepers in use in the country, but it is challenging to determine the exact percentage used for drug trafficking. According to U.S. Drug Enforcement Administration officials, beepers were introduced to the drug market approximately five years ago by Colombian cocaine organizations and have been utilized by bookies and cigarette smugglers as well. Presently, federal narcotics agents believe that at least 90 percent of drug dealers employ beepers.As the Bitcoin network has gained more mainstream acceptance (moving beyond its early Silk Road days), algorithms can now easily analyze the public ledger, making it less favorable for criminal activities. Chainalysis, an analysis firm that assists law enforcement agencies and private institutions in examining public blockchains, has conducted multiple annual studies and determined that only 0.5% to 2% of cryptocurrency transactions are associated with illegal activities in a given year.Chart Source: ChainalysisSince the year 2000, investment banks alone have paid fines totaling over $331 billion for various illegal activities within the fiat currency system.Therefore, when incidents like the $4.4 million ransomware attack on Colonial Pipeline occur, where bitcoin is used as the payment medium, it is crucial to consider the overall numbers and relative scale of such events rather than relying solely on narratives about how bitcoin is used, based on individual examples. In the case of the Colonial Pipeline attack, a significant portion of the funds was recovered as the coins associated with the ransomware attack could be traced, and it appears that the hackers did not store their funds in a private hardware wallet.Numerous studies have been conducted to determine the percentage of global GDP attributed to illegal activities, including the "shadow economy" that encompasses both illegal and semi-illegal economic practices. A paper published by the World Bank in July 2010 found that, on a weighted-average basis across 162 nations between 1997 and 2007, the shadow economy accounted for 17.2% of GDP. Investopedia has compiled several studies over the years, with estimates ranging from 12% to 14%, while lower-end studies suggest around 7%. A study by the US Bureau of Economic Analysis (BEA) indicated that incorporating theft from businesses, illegal gambling, prostitution, and drug trafficking would add 1% to 4% to the US GDP annually, without considering theft from individuals, human trafficking, and other shadow economy activities. The United Nations Office on Drugs and Crime estimates that global money laundering amounts to 2% to 5% of global GDP. Moreover, an often-cited older study revealed that approximately 80% of cash bears traces of cocaine.In essence, when considering the 0.5% to 2% criminal activity associated with Bitcoin and the broader cryptocurrency space, it becomes apparent that these technologies ironically have a lower share of illicit transactions compared to fiat currency on a percentage-of-transaction basis. This outcome is reasonable since criminals are unlikely to engage in nefarious activities on an immutable public ledger that is susceptible to tracking and analysis. In many cases, the traditional method of using a private suitcase filled with cash remains preferable for such purposes.While some blockchains offer stronger privacy features than the Bitcoin network, they often make trade-offs in terms of reliability and security to achieve this privacy. In other words, the Bitcoin network provides privacy enhancements over many banking activities, particularly when utilizing lightning or other privacy methods. The upcoming Taproot update will further improve privacy to some extent. However, it is important to note that Bitcoin is not as private as physical cash when subjected to rigorous on-chain analysis.Application 4: Protection Against Negative Interest Rates or Phasing Out of Cash

During economic downturns, central banks often reduce interest rates by a significant margin. However, after years of such rate cuts, interest rates in developed countries have reached near-zero levels, leaving limited room for further reductions. While rates can moderately go into negative territory, around -0.5%, people are willing to accept a small cost for the security of keeping their money in banks instead of hoarding it at home. But if rates were to drop to, let's say, -4%, many individuals would likely withdraw their cash from banks. They wouldn't allow their $1000 to decrease to $960 in the first year and continue dwindling to $921 in the second year, and so on.The International Monetary Fund (IMF) published an article in 2019 titled "Cashing in: How to Make Negative Interest Rates Work," which aptly explains the issue In a cashless society, there would be no lower limit on interest rates. A central bank could reduce the policy rate from, let's say, 2% to as low as -4% to combat a severe recession. This interest rate cut would impact bank deposits, loans, and bonds. Without physical cash, depositors would have to pay the negative interest rate to keep their money with the bank, making consumption and investment more appealing. This would stimulate lending, increase demand, and bolster the economy.However, when physical cash is available, significantly lowering interest rates into negative territory becomes impractical. Cash holds the same purchasing power as bank deposits but offers zero nominal interest. Additionally, individuals can obtain cash in unlimited quantities by exchanging it for bank money. Therefore, instead of paying negative interest, people can simply hold cash at zero interest. Cash essentially acts as a safeguard against negative interest rates, setting a floor for interest rates.Due to this floor, central banks have turned to unconventional monetary policy measures. Economies such as the euro area, Switzerland, Denmark, Sweden, and others have allowed interest rates to slightly dip below zero, partly because withdrawing large amounts of cash is inconvenient and costly (e.g., storage and insurance fees). These policies have helped stimulate demand, but they cannot fully compensate for the diminished policy space when interest rates are extremely low.One potential solution to overcome the zero lower bound on interest rates would involve gradually phasing out physical cash.A 2018 IMF working paper, which is linked in the mentioned article, delves into this topic in greater detail. However, completely eliminating cash presents significant challenges. Instead, the paper proposes splitting the monetary base into two parts: physical cash and cash stored in the financial system. Physical cash would then devalue relative to deposited cash at a rate equivalent to the negative rates applied to deposited cash. This approach effectively extends negative rates to physical cash, leaving no escape from deeply nominal negative interest rates.In a 2019 NBER Working Paper (25416), co-authored by Larry Summers, the issues associated with paper currency against substantially negative-rate policies are further explored.The paper suggests that if the lower bound on deposits can be surpassed, negative policy rates could effectively stimulate the economy. This could occur if banks gradually become more willing to experiment with negative deposit rates, and depositors do not shift to using cash as an alternative. Institutional changes that affect the deposit lower bound are also considered. Examples of such policies include implementing a direct tax on paper currency, as proposed by Gesell (Gesell, 1916) and discussed by Goodfriend (2000) and Buiter and Panigirtzoglou (2003), or measures that increase the cost of storing money, such as the elimination of high denomination bills. Another possibility discussed is the complete abolition of paper currency. These policies are examined in works by Agarwal and Kimball (2015), Rogoff (2017a and 2017c), among others, who also suggest more intricate policy frameworks to circumvent the zero lower bound.In 2020, instead of resorting to deeply negative interest rates, governments leaned more towards employing pro-inflationary fiscal policies. This approach mirrors the response during the 1930s and 1940s, the last time the zero lower bound was reached as part of the previous peak of the long-term debt cycle.In the long run, it is more likely that greater reliance will be placed on fiscal policy at the zero lower bound to initiate the next economic cycle, rather than excessive use of monetary policy involving nominal interest rates as low as -4%. However, it is crucial to monitor influential papers like the ones mentioned to understand how policymakers are contemplating policy measures.In 2021, China has been conducting trials of a central bank digital currency. This digital currency offers several features: a) it facilitates easier tracking and blocking of transactions, b) it enables the establishment of expiration dates on money to encourage spending rather than saving, and c) it allows for automatic deductions and freezing of accounts associated with specific entities. A Wall Street Journal article from April 2021 provides some insights:China has indicated that the digital yuan will coexist with physical bills and coins for a considerable period. However, experts in banking and other fields believe that Beijing aims to eventually digitize all of its currency, although this aspect has not been addressed by the government.The digital currency itself is programmable. Beijing has experimented with expiration dates to incentivize users to spend the money quickly, particularly during times when the economy requires a boost.Moreover, the digital currency is trackable, which adds to China's extensive state surveillance capabilities. The government already employs hundreds of millions of facial-recognition cameras to monitor the population, sometimes using them to impose fines for activities like jaywalking. With a digital currency, it would be possible to swiftly issue and collect fines as soon as an infraction is detected.According to CBDC Tracker, a research group, more than 60 countries are currently engaged in the study or development of digital currencies.Agustin Carstens, the head of the Bank for International Settlements (BIS), which serves as the central bank for central banks and is based in Switzerland, shared an interesting perspective on central bank digital currencies (CBDCs) in the past year. He stated that when analyzing CBDCs for general use, they consider them equivalent to cash but highlight a significant difference. With cash, it is impossible to know who is using a specific denomination like a hundred-dollar bill or a one-thousand-peso bill. Conversely, CBDCs would grant central banks complete control over the rules and regulations governing the usage of the digital currency, and they would possess the technology to enforce those regulations. These factors create a substantial distinction between CBDCs and cash.Given these considerations, it is not surprising that a significant portion of people might choose to rely on alternative assets like physical gold or encrypted bearer asset networks to safeguard a portion of their savings and avoid the potential implications associated with centralized control over digital currencies. While it may not be advisable to place all of one's wealth in physical cash, gold, or self-custodied bitcoin, it is prudent to allocate a non-zero portion of one's net worth to such assets.When Self-custody isn;t Required by Investors

Different societies exhibit varying levels of collectivism or individualism, and even within those societies, individuals fall along a spectrum in terms of their trust in the system.People's perspectives on assets like gold or bitcoin are often influenced by their life experiences and personal dispositions. Growing up in an environment where things generally function smoothly, without major currency failures or oppressive regimes, tends to foster trust in institutions. Such individuals may be comfortable with the idea of centralization and willingly relinquishing certain rights in exchange for conveniences.From this viewpoint, gold is often perceived as a relic favored by grumpy individuals who criticize the Federal Reserve, while bitcoin is seen as a speculative asset popular among millennials or even as a haven for illicit activities. However, by broadening our understanding of diverse lived experiences across the world, we can appreciate why these types of assets hold appeal for many people.When it comes to investing in self-custodied assets like gold or bitcoin, it is important to note that not everyone needs to personally handle the custody of these assets.As long as individuals comprehend the reasons behind the desire for self-custody and recognize the value of owning assets that can be self-custodied, they have the option to invest in these assets through custodians if they prefer or if regulatory requirements dictate so.In other words, the inherent feature of self-custody in these assets, which allows them to be held as bearer assets, is a significant aspect of their value proposition. However, not every user needs to personally hold custody of their allocation to these assets. They can opt to hold cash in a bank, invest in a gold ETF, purchase shares of gold mining companies, acquire bitcoin through a fund or custodian, or explore other alternatives if they prefer or are compelled to do so due to regulatory constraints.Gaining Insight into the Opposition

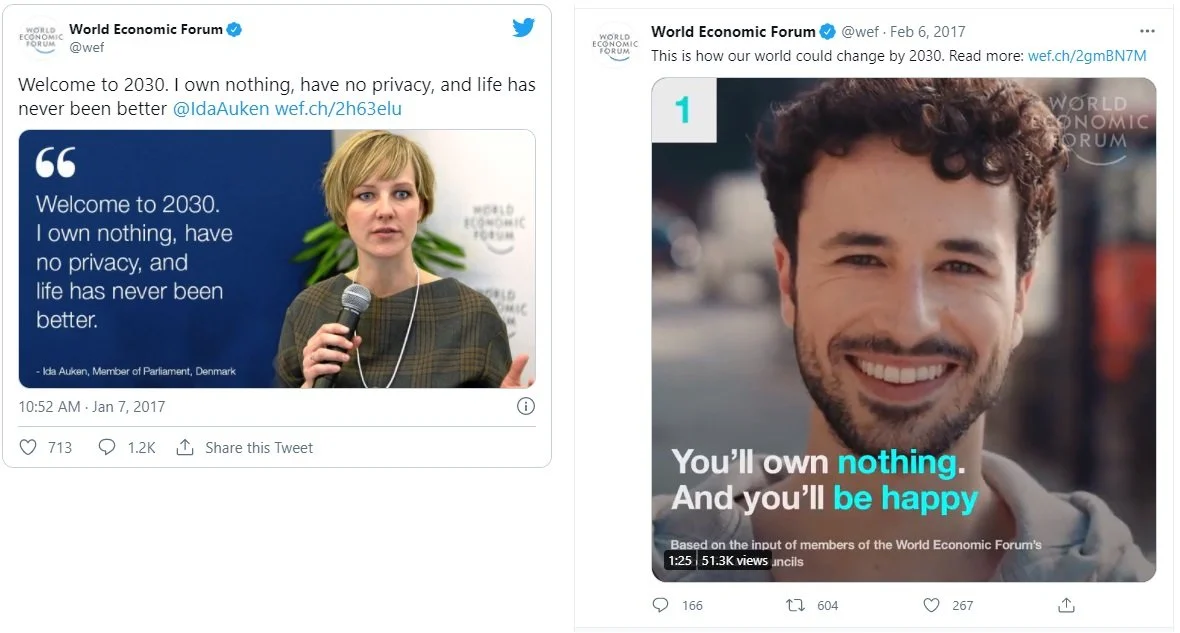

In 2016, the World Economic Forum published a blog article titled "Welcome to 2030: I Own Nothing, Have No Privacy, and Life has Never Been Better" by Danish politician Ida Auken. This was followed by a 2017 social media campaign by the World Economic Forum that incorporated themes from the article.The main focus of the article and campaign was the idea that society is shifting towards a model where services are prioritized over ownership. For those unfamiliar, the World Economic Forum hosts the annual Davos gathering, which brings together politicians and business leaders from around the world to influence policy and exchange ideas.Auken's article envisioned a somewhat utopian and dystopian scenario for the year 2030, where people would have access to everything they need as services, facilitated by advancements in artificial intelligence and robotics. However, individuals would own very little and their every move would be tracked without any privacy. The narrative included some individuals who had chosen to live in the countryside, away from this regime. Auken's imagined self in 2030 expressed concern for these people while also being content with her own life despite the privacy concerns, viewing many of the measures taken as necessary.In late 2020, the World Economic Forum's chairman, Klaus Schwab, gained renewed attention with his Time Magazine cover article and media campaign titled "The Great Reset," which discussed responding to the pandemic crisis by reevaluating global priorities.This led to the emergence of online conspiracy theories portraying Schwab as a sinister figure akin to a James Bond villain or leader of the Illuminati, with a grand plan. Reuters Fact Check team investigated these theories and deemed them conspiracies.Following the viral activity, the World Economic Forum deleted several of their 2017 tweets and the original 2016 blog post, presumably realizing that the campaign did not resonate well as a marketing strategy. However, the 2016 version of the article on Forbes' website still remains at the time of writing.Both the initial campaign and the subsequent viral conspiracy backlash offer valuable insights, regardless of their positive or negative implications. They highlight the cultural divisions that exist and it is important to understand how different individuals perceive the world.While some individuals may have taken these articles and media campaigns to an extreme and misinterpreted their scope, it is understandable that others saw them as indications of encroachment on personal autonomy, privacy, and property by policymakers and influential figures, in terms of the overall direction things are heading.Hence, it is not surprising that a significant group of people prefer to have some form of self-custody over their assets. This explains the popularity of bearer assets like gold, silver, and bitcoin. These individuals do not wish to "own nothing and be happy"; instead, they desire to have control over their monetary assets by taking custody of them.